An Unbiased View of Private Wealth Management copyright

Wiki Article

What Does Independent Financial Advisor copyright Do?

Table of ContentsTop Guidelines Of Lighthouse Wealth ManagementA Biased View of Private Wealth Management copyrightLighthouse Wealth Management Can Be Fun For Everyone6 Easy Facts About Retirement Planning copyright ExplainedThe Financial Advisor Victoria Bc StatementsPrivate Wealth Management copyright Fundamentals Explained

Heath can be an advice-only coordinator, consequently he doesn’t control their customers’ cash right, nor really does he offer all of them certain financial loans. Heath claims the appeal of this approach to him is he doesn’t feel certain to supply a certain product to fix a client’s cash dilemmas. If an advisor is prepared to sell an insurance-based solution to difficulty, they might end steering some one down an unproductive road in the name of striking income quotas, according to him.“Most monetary services folks in copyright, because they’re settled in line with the services and products they provide and sell, they could have motivations to advise one strategy over another,” according to him.“I’ve picked this program of motion because I'm able to hunt my customers in their eyes and never feel like I’m benefiting from all of them in any way or attempting to make a sales pitch.” Story continues below advertisement FCAC notes the way you spend the advisor depends upon this service membership they provide.

Some Known Factual Statements About Investment Consultant

Heath with his ilk tend to be settled on a fee-only product, therefore they’re compensated like an attorney could be on a session-by-session foundation or a hourly assessment price (lighthouse wealth management). According to the array of solutions plus the expertise or typical customer base of your expert or coordinator, hourly fees ranges from inside the 100s or thousands, Heath claimsThis is as high as $250,000 and above, he says, which boxes around the majority of Canadian households using this standard of solution. Story continues below ad for people incapable of spend fees for advice-based methods, and for those not willing to quit a percentage of these expense comes back or without enough money to begin with an advisor, you will find several more affordable and also no-cost choices to consider.

Ia Wealth Management for Beginners

Story continues below advertising discovering the right monetary planner is a bit like matchmaking, Heath states: You want to find some one who’s reliable, provides an individuality fit and is suitable individual the phase of life you are really in (https://packersmovers.activeboard.com/t67151553/how-to-connect-canon-mg3620-printer-to-computer/?ts=1706079058&direction=prev&page=last#lastPostAnchor). Some choose their particular advisors getting more mature with much more experience, he states, while some favor someone more youthful who are able to hopefully stick to all of them from very early decades through your retirement

Investment Consultant Can Be Fun For Everyone

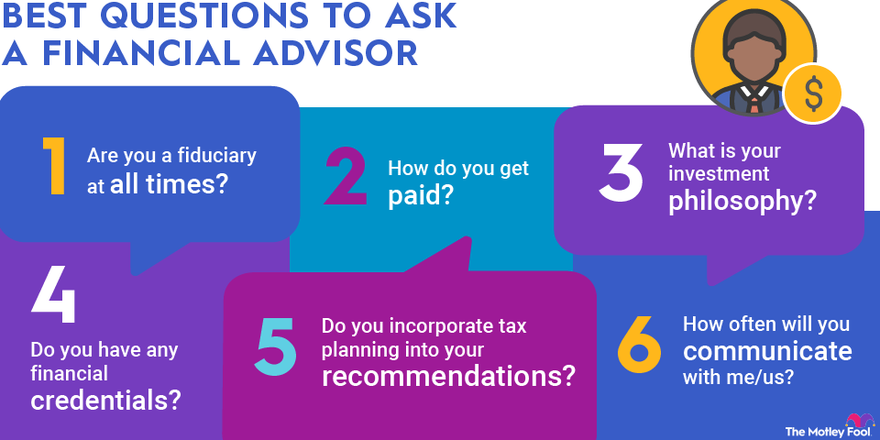

One of the greatest blunders some one can make in choosing an expert just isn't inquiring adequate questions, Heath states. He’s astonished as he hears from consumers that they’re nervous about asking questions and potentially appearing foolish a trend the guy locates is as normal with developed experts and older adults.“I’m shocked, as it’s their funds and they’re having to pay a lot of costs to those people,” he says.“You deserve for your questions answered and also you have earned for an unbarred and sincere connection.” 6:11 Financial Planning for all Heath’s final advice is applicable whether you’re in search of outside financial support or you’re heading it alone: educate yourself.Listed below are four facts to consider and ask your self when determining whether you ought to tap the expertise of a monetary expert. Your own web worth is certainly not your income, but rather a quantity which can help you recognize what money you earn, simply how much it can save you, and the place you spend money, too.

How Financial Advisor Victoria Bc can Save You Time, Stress, and Money.

Your infant is on just how. Your own splitting up is actually pending. You’re nearing retirement. These along with other significant existence events may remind the requirement to see with an economic expert regarding the financial investments, your financial targets, and other monetary issues. Let’s say your own mom kept you a tidy sum of cash in her own might.

You could have sketched out your own economic strategy, but have difficulty sticking with it. A financial advisor may offer the liability that you need to place your monetary intend on track. They even may suggest simple tips to tweak your monetary program - https://www.livebinders.com/b/3567174?tabid=aaafba60-2a7e-3bde-f5e7-f44030d8dc70 so that you can maximize the possibility outcomes

The Basic Principles Of Ia Wealth Management

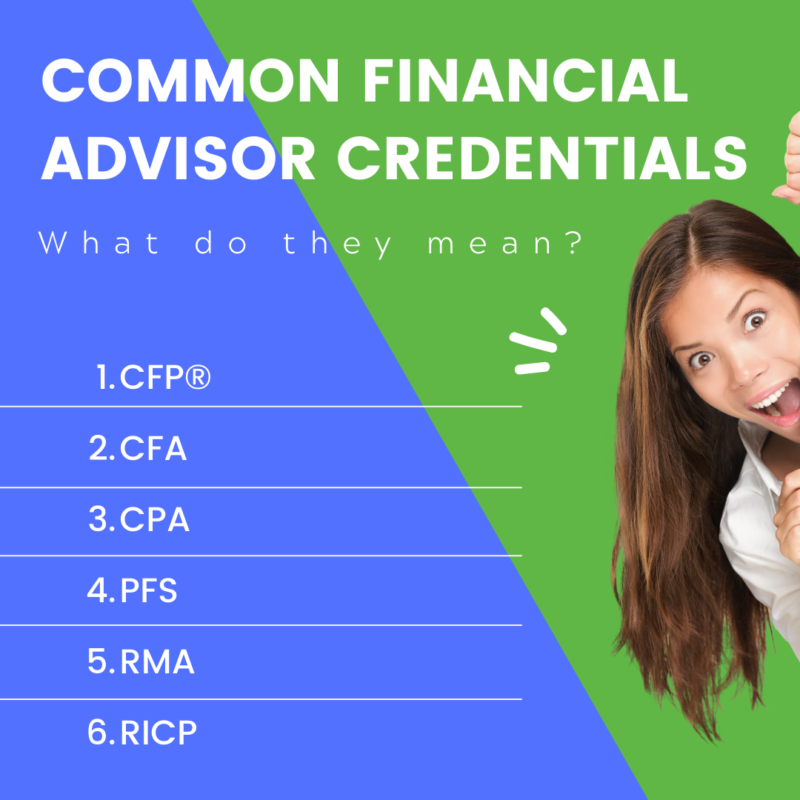

Anyone can say they’re a financial advisor, but a consultant with pro designations is ideally usually the one you really need to hire. In 2021, around 330,300 People in the us worked as individual monetary advisors, in line with the U.S. Bureau of work Statistics (BLS). Many economic advisors tend to be self-employed, the bureau claims - retirement planning copyright. Normally, there are five different financial analysts

Agents typically obtain profits on deals they make. Agents are managed by U.S. Securities and Exchange Commission (SEC), the economic field Regulatory Authority (FINRA) and state securities regulators. A registered financial investment expert, either people or a firm, is a lot like a registered representative. Both trade financial investments with respect to their clients.

Report this wiki page